Equity monthly view for June 2021

Posted On Wednesday, Jul 07, 2021

S&P BSE SENSEX increased by 1.29% on a total return basis in the month of June-21. After a strong rally in the month of May-21, equity markets have further consolidated gains this month. Sensex has underperformed global indices such as S&P 500 & MSCI world Index that appreciated by 2.34% & 1.52%, respectively, during the month. It has, however, outperformed MSCI Emerging Market Index.

The broader market has done better than the Sensex again this month. The S&P BSE Midcap Index appreciated by 3.66%, and the S&P BSE Small-cap Index rose by 6.98%. Since May 2020, the midcap index has not given a negative monthly return (month on month basis) till-date. Even the small-cap index has given negative monthly returns only once (month on month basis) in the past thirteen months.

Quantum Long Term Equity Value Fund saw a 1.43% appreciation in its NAV in the month of June 2021 compared to a 1.63% appreciation in its benchmark S&P BSE 200.. Cash in the scheme stood at approximately 8.5% at the end of June. We continue to align the portfolio towards the cyclical recovery in the economy without undermining the risk associated with pandemic-related economic upheavals.

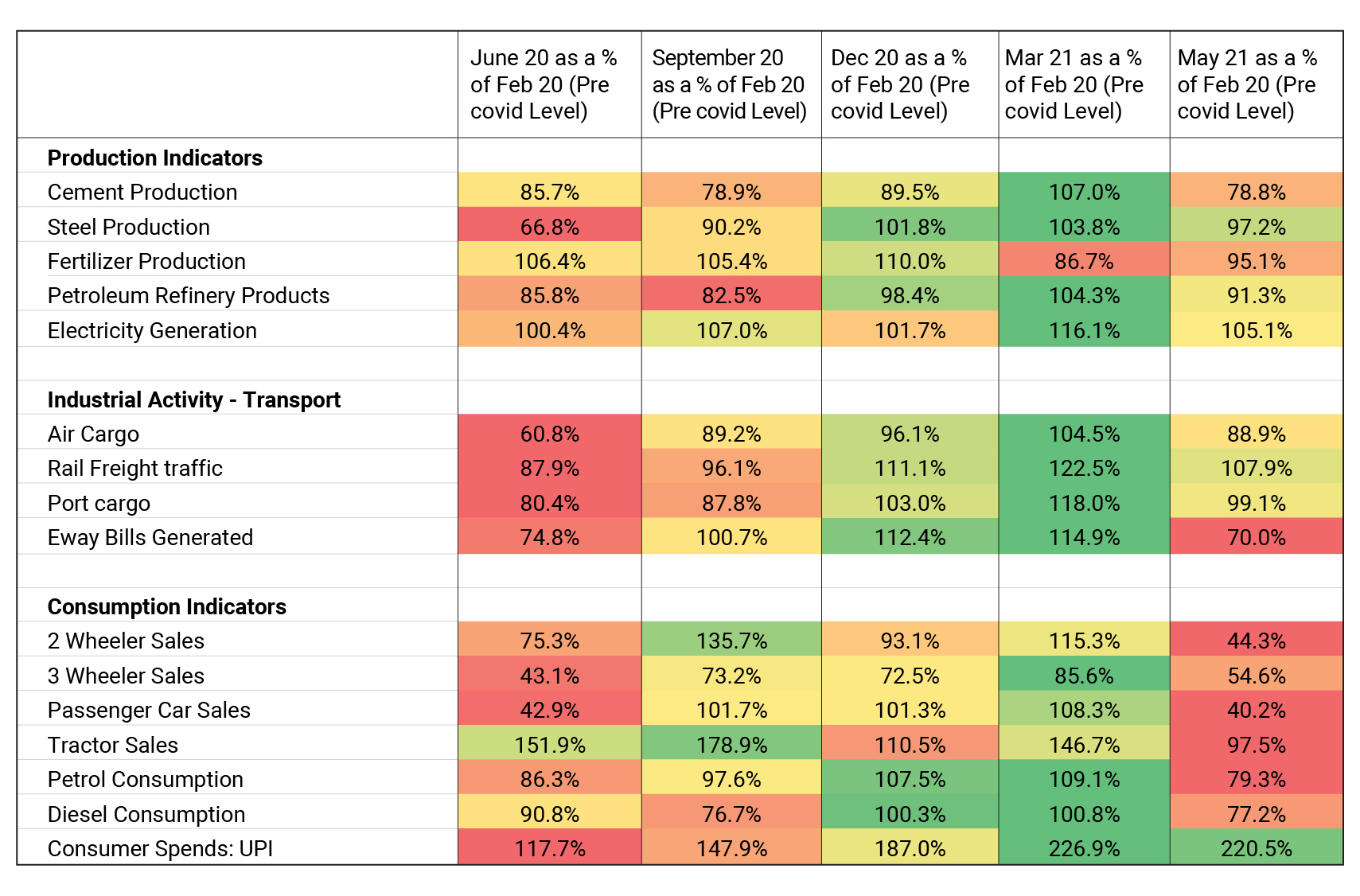

The month of June has seen restrictions easing mobility across most states. Improvement in Covid-19 related data (daily new cases, active cases, daily fatalities all are trending down) has given the local state governments some headroom to ease restriction and allow routine economic activity. The monthly economic indicators will show improvement from June-2021 onwards. However, since the lockdown has been less severe this time, we expect the pent-up recovery to be softer than what we witnessed after the first lockdown. Over the next 12 months, sustainability of economic activity and improvement in corporate earnings will hinge upon whether we will have a third wave of Covid-19 infections and another round of lockdown or not. If we can achieve universal vaccination sooner than later & do not encounter the third wave, we will have a faster economic rebound.

Data Source: CMIE, RBI, ewaybill.nic.in Data as on June 2021

Monsoons are off to a good start:

The southwest monsoon has progressed well in the month of June-21. The cumulative rainfall for the country has been 18% (169mm) higher than normal rainfall (historical average of 143mm). However, June accounts for just 16-17% of the monsoon rains. July & August are more important months (accounting for 65-70% of monsoon rainfall). The meteorological department has indicated a brief lull in monsoon progress in the first week of July. It could be crucial for Kharif sowing as rainfall distribution is as important (if not more) as the total rainfall.

FII have turned buyers:

After turning sellers for the last two months, FIIs have again turned buyers Indian Equities in June-21. They have bought US$ 2.3 bn worth of Indian Equities this month vs. selling of $ 388 mn in May-21. On a YTD basis, FPI inflows stand at US$ 8.31 bn. DIIs have been buyers in the month of June-21 to the tune of US$ 950 mn. The sharp reversal in global interest rates and recurrence of covid-19 induced uncertainty remains a risk to near-term foreign flows.

Equity Markets trading at a premium relative to history:

Indian Equity markets have welcomed the reduction in Covid-19 active caseload and moved up sharply since mid of May-21. It has continued in the month of June-21 as well. Markets are already factoring in improvement in economic data and pent-up demand. Global markets too remained resilient despite Fed commentary suggesting that rising inflation can result in rate hikes in 2023. The benchmark BSE S&P Sensex is trading close to 22.6x FY22 consensus earnings, while the long-term average PE is close to 18x. So, Sensex is trading at a premium relative to its history. The midcaps & small caps appear even more expensive.

The likelihood of a Covid-19 third wave & another economic lockdown is the most critical variable right now for market direction. Besides that, corporate earnings in the June-21 quarter and management commentary on demand & raw material inflation will also set the tone for future earnings growth trajectory for companies. Another important variable that has emerged over the last few months is inflation. Inflation reading has been higher than RBI’s comfort for a couple of months now. If this high inflation seeps into manufactured goods & food prices, it will force RBI to react with rate hikes resulting in nipping the economic recovery in the bud.

Notwithstanding the market rally & economic uncertainty, equity markets are heterogeneous, allowing active managers like us to find pockets of undervaluation to create a portfolio with a reasonable margin of safety with a long-term perspective. We believe the cyclicals like financials, commodities, and consumer discretionary have the potential to see earning upgrades, in a typical economic recovery environment. Technology stocks are a good play on the global economic recovery. The business case has strengthened for them during the pandemic as technology spends have become part of business continuity plans for corporates across the globe.

Retail investors should stagger their investments to achieve the best results from their equity allocations. Specifically, midcaps & small-cap investors need to tread with abundant caution at current levels.

Data source: NSDL

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk-o-Meter is based on the portfolio of the scheme as on May 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly for March 2026

Posted On Monday, Mar 02, 2026

Markets were range bound with a marginal decline in Sensex. BSE mid and small cap indices

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More