A Better Way To Park Your Emergency Fund

Posted On Wednesday, Oct 27, 2021

This pandemic has been a wake-up call for all of us and has stressed the importance of having a sound financial backup plan. A plan that can help you meet unforeseen expenses whether that be a health emergency or unemployment etc. If you are in urgent need of funds, you will likely redeem or liquidate your investments in the spur of the moment and without thinking twice.

However by fully redeeming your holdings, you stand to disrupt your wealth creation goals. Instead, we have an alternative for you, a safe option that will not only provide liquidity when you need it but also will continue to earn you returns until you actually “use” the funds.

Instead of completely withdrawing your investment and leaving it idle in a bank account, you can “SWITCH” or move units from your current fund temporarily to a Liquid Fund.

Let’s first understand how Switch differs from Redemption:

Switch vs. Redemption: Redemption is when you sell your mutual fund units either partially or completely and the specified amount is credited to your bank account. Whereas Switching means transferring from one Quantum Mutual Fund to another within the Quantum Family. |

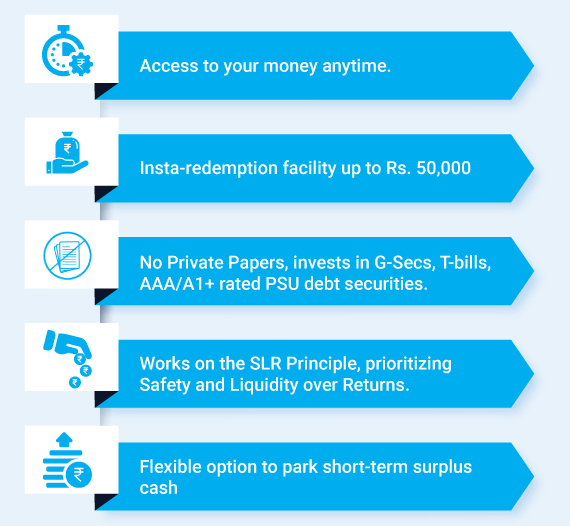

A Liquid fund is similar to a saving Bank account in several ways while offering additional benefits as outlined below:

Quantum Liquid Fund – Salient Features

To facilitate the ease of Switching in an emergency or otherwise, it is a good idea to start your Quantum Liquid Fund today to avoid any unnecessary administrative delays. You can start investing in Quantum Liquid Fund with lumpsum of Rs.5000 and thereafter make additional purchase with an SIP (Systematic Investment Plan) of just Rs. 500, and build it from there.

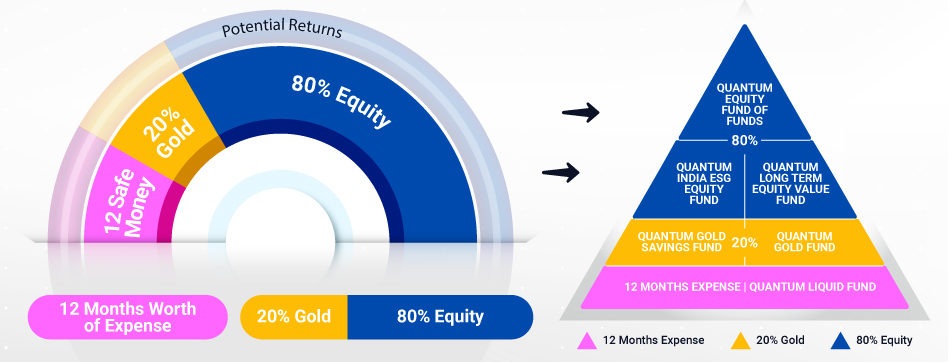

Safe Money As Part of Your Asset Allocation

Nobody knows how long the Coronavirus pandemic will continue and how much time will it take for the economy to recover. So, it’s a good idea to anyway have safe money as part of your portfolio to take care of unforeseen expenses.

Ideally, you need to deploy enough money to keep up your consumption pattern for 12 months or longer, depending on your risk appetite.

After you have the sufficient safe money, you can then think of further adding to your Equity or Gold portfolio using the 12-20-80 Quantum Asset Allocation Strategy.

Please note that the above suggested fund allocation only and is not to be considered as investment advice / recommendation, please seek independent professional advice and arrive at an informed investment decision before making any investments.

So, there are three reasons why consider a Liquid Fund as part of your investment portfolio.

✔ Balancing your portfolio from an asset allocation standpoint

✔ Safe money during times of emergencies.

✔ Ability to “Switch” investments easily in times of need without sacrificing opportunities

Add Quantum Liquid Fund to your portfolio today to reap the benefits of diversification, safety, liquidity and returns!

Product Labeling

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Income over the short term • Investments in debt / money market instruments. |  Investors understand that their principal will be at Low Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Moderate Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Sep 30, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for December 2025

Posted On Tuesday, Dec 02, 2025

As we approach the end of the calendar year, we find ourselves at a pivotal moment, with the market split on the likelihood of an upcoming rate cut.

Read More -

Debt Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

October 2025 in a Nutshell: Monetary Policy and Demand–Supply

Read More -

Debt Monthly for October 2025

Posted On Friday, Oct 03, 2025

September was a pivotal month for fixed income markets, both globally and domestically.

Read More