About The Fund

The Quantum Liquid Fund (QLF) was the second fund launched by Quantum (in the year 2006) and is ideal for investors who want a savings bank account type of investment. The primary objective of the Liquid Fund is thus to ensure that your investments are made prudently in safe and liquid instruments to earn slightly higher returns than interest on a bank savings account. The fund prioritizes Safety and Liquidity over Returns and invests pre-dominantly in Government Securities, Treasury Bills and Money Market instruments issued by Public Sector Undertakings. Investors can also use QLF as a fund to make regular investments into the Quantum Value Fund through the systematic transfer plan route.

5 Reasons to Invest in the Quantum Liquid Fund

1. Invests only in Government Securities, Treasury Bills and AAA/A1+ rated Public Sector Undertakings.

2. No Private Corporate Credit Risk.

3. Marked-to-market daily to ensure that the declared NAV is real.

4. High Portfolio liquidity and stable AUM trend.

5. Weekly Disclosure of Portfolios.

Portfolio

Fund Managed By

Funds Managed:

Qualification:

- B.Com Degree, CA Inter, Pursuing CFA

-

Funds Managed:

Qualification:

- B.Com Degree and Master of Business Administration in Finance

How To Invest

Invest Online in 3 easy steps. Click here to Get Started and plan your Asset Allocation!

Product Label

-

Name of the Scheme and Benchmark

Quantum Liquid Fund

(An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk.)

Tier I Benchmark : CRISIL Liquid Debt A-I Index -

This product is suitable for investors who are seeking*

• Income over the short term

• Investments in debt / money market instruments

-

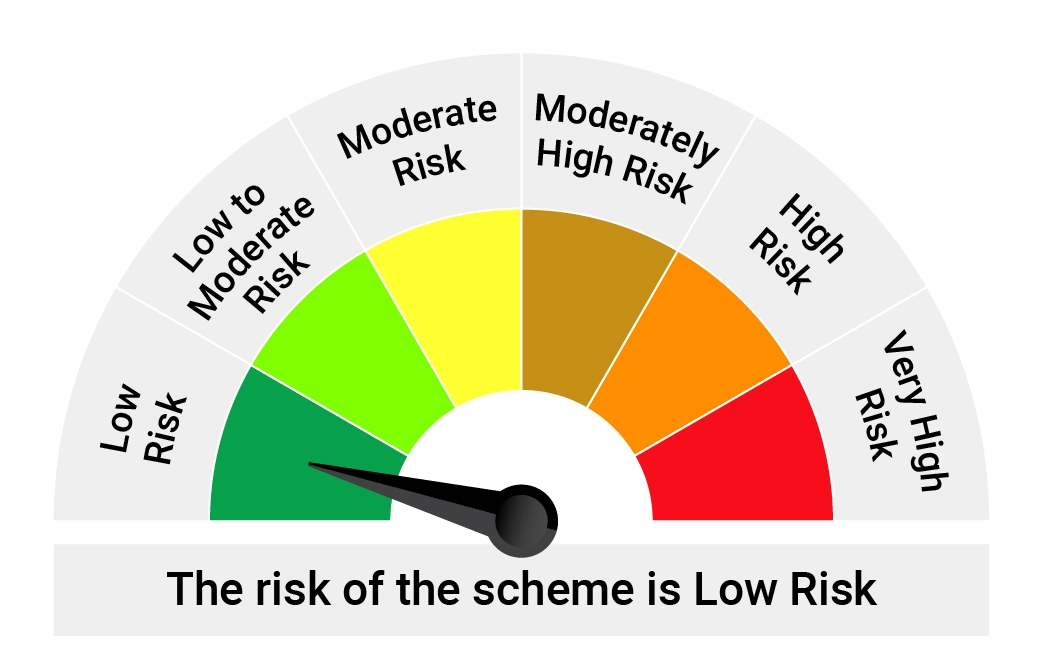

Risk-o-meter of Scheme

-

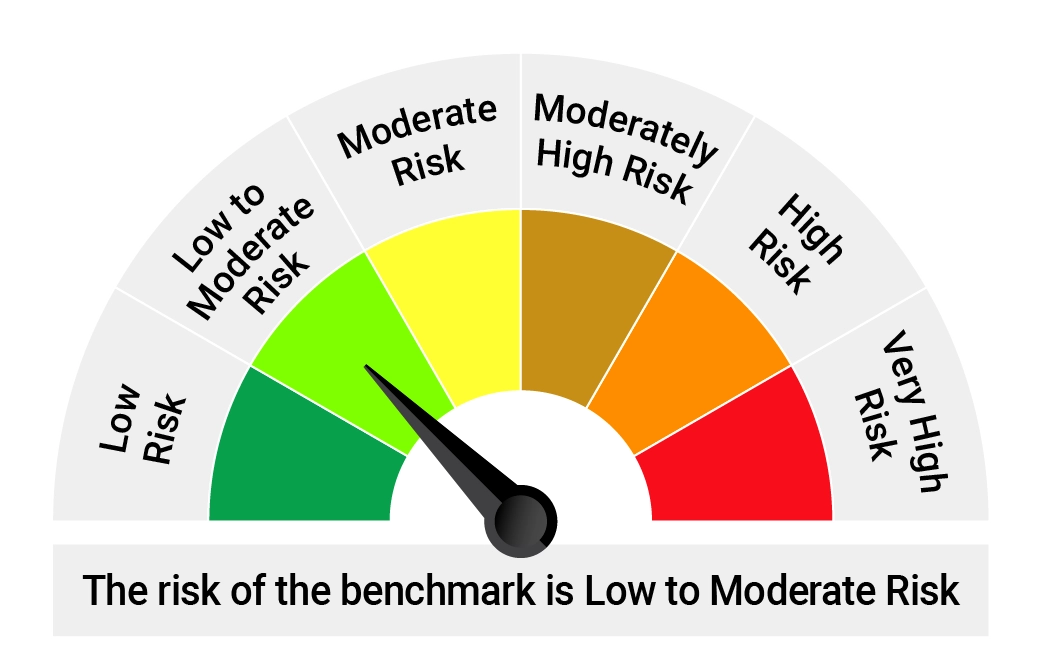

Risk-o-meter of Tier-I Benchmark

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Potential Risk Class Matrix – Quantum Liquid Fund

-

Credit Risk →

Interest Rate Risk ↓

Relatively Low (Class I)

Moderate (Class II)

Relatively High (Class III)

-

Relatively Low (Class A)

A-I

-

Moderate (Class B)

-

Relatively High (Class C)

Frequently Asked Questions

Liquid funds are debt funds that invest in short term debt and money market securities with maturities up to 91 days. Since market prices of short-term debt securities do not change as much as long term bonds, generally returns on liquid funds are relatively less volatile compared to most of the other debt fund categories. Returns on liquid funds are contributed mainly through interest accruals on their holdings of debt securities.

Liquid funds invest in very short term assets like treasury bills, government securities, repos, certificate of deposits, commercial papers etc. These can invest only in debt securities with residual maturity of up to 91 days.

Fund managers of Liquid Funds typically aim to invest into good credit quality and liquid debt instruments. Furthermore, liquid funds are mandated to hold at least 20% of their portfolio in liquid assets such as cash and cash equivalents, treasury bills, government securities and repo on government securities.

Liquid funds are considered least risky among all the debt funds categories except for the overnight fund. However, low risk does not mean no risk. Like any other debt fund, liquid funds are exposed to three main risks – interest rate risk, credit risk and liquidity risk.

The mandated maturity cap of 91 days, likely to keep the interest rate risk to minimum levels as prices of short term debt instruments generally does not change much with changes in market interest rates. However, credit and liquidity risks depend on the credit quality of debt instruments held by the liquid fund. This can differ vastly across different liquid funds. Liquid funds investing higher proportion of its assets in government securities and AAA rated debt are considered less risky.

Liquid funds are generally suitable for a wide range of investors, including:

• Investors who have short-term investment horizon or are not willing to take much risk in their fixed income allocation.

• Investors who want to temporarily park large sum of money, say from a bonus, property sale, inheritance etc, until they decide how to invest that corpus

• Investors who want to stagger their investment in equity schemes through SIPs can park in liquid funds and opt for systematic transfer plan (STP)

• Investors who want to keep contingency funds or emergency corpus in relatively low risk debt schemes.

Yes, Liquid funds are taxable.

If the investment is held for more than 3 years, it is subjected to long term capital gains which is taxable at 20% with indexation benefit. This means that the purchase price is increased to adjust for inflation (using an index provided by the Government) before calculating the capital gain. This reduces the tax liability significantly for investors in high income tax bracket.

If the investment is redeemed before 3 years period, it is considered as short term capital gain. This is taxed at the income tax slab rate applicable to the investor.

If the money is withdrawn within seven days of investing, liquid funds charge an exit load of 0.0070% to 0.0045% of the redemption amount.