Covid Vaccine: End of the Pandemic and Gold's Incredible Rally?

Posted On Friday, Dec 04, 2020

Finally, we are inching closer to the reality of a vaccine! Pfizer, Moderna and Oxford-AstraZeneca have revealed promising results in late stage clinical trials for a potential Covid-19 vaccine.

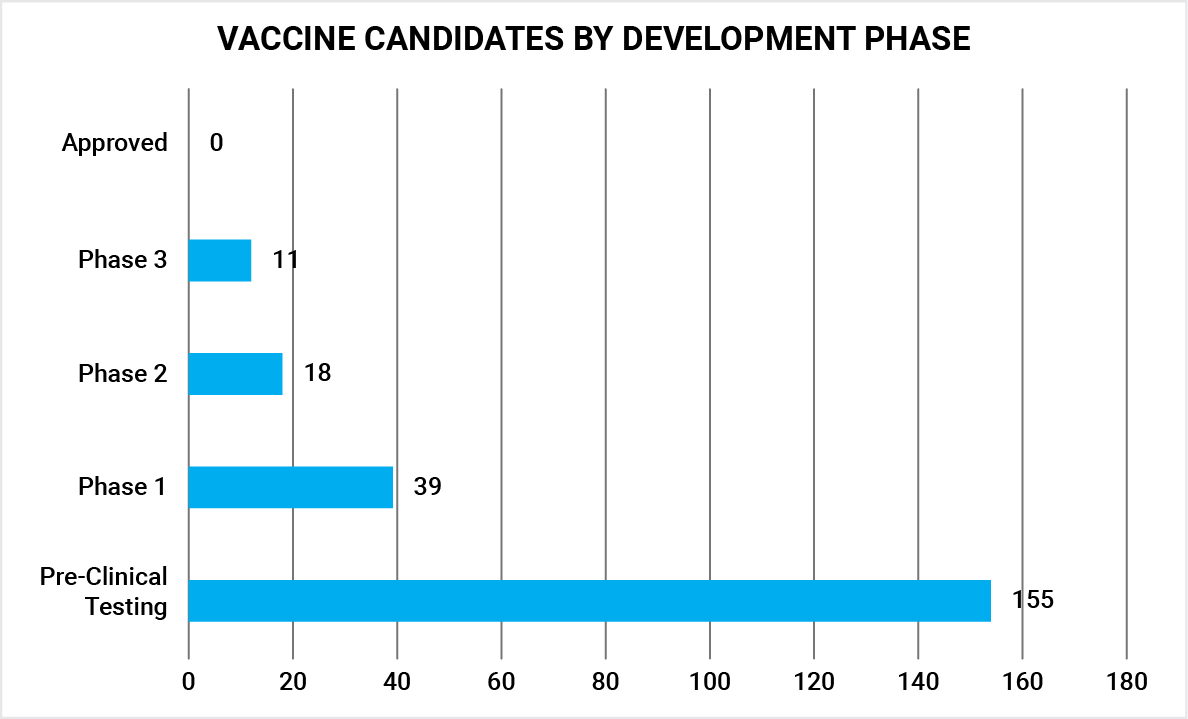

Source: WHO as on Nov 09, 2020

Surprised? Not really. With more than 200 vaccines in development globally, and half a dozen in phase 3 human clinical trials, we were expecting a viable vaccine by the end of the year. And we were also expecting a knee jerk reaction in gold prices as and when that happens. Indeed, gold prices corrected by 5% in November due to the renewed risk sentiment.

Experts are waiting to see more data and pointed out that questions about efficacy, regulatory approval, timing, costs and distribution of the vaccine need to be answered.

Realistically, the vaccine may not come to local pharmacies for the general public any time soon.

We believe that a vaccine’s impact on gold prices is overestimated. Remember, gold prospects had turned brighter with a u-turn in monetary policies of the Federal Reserve in 2019 as the economy was fast losing steam, even before Covid-19 struck. The pandemic was a tail wind for gold but fundamentally that doesn't alter the prospects dramatically. Here are top five reasons why:

1. Vaccine efficacy and timelines are concerns

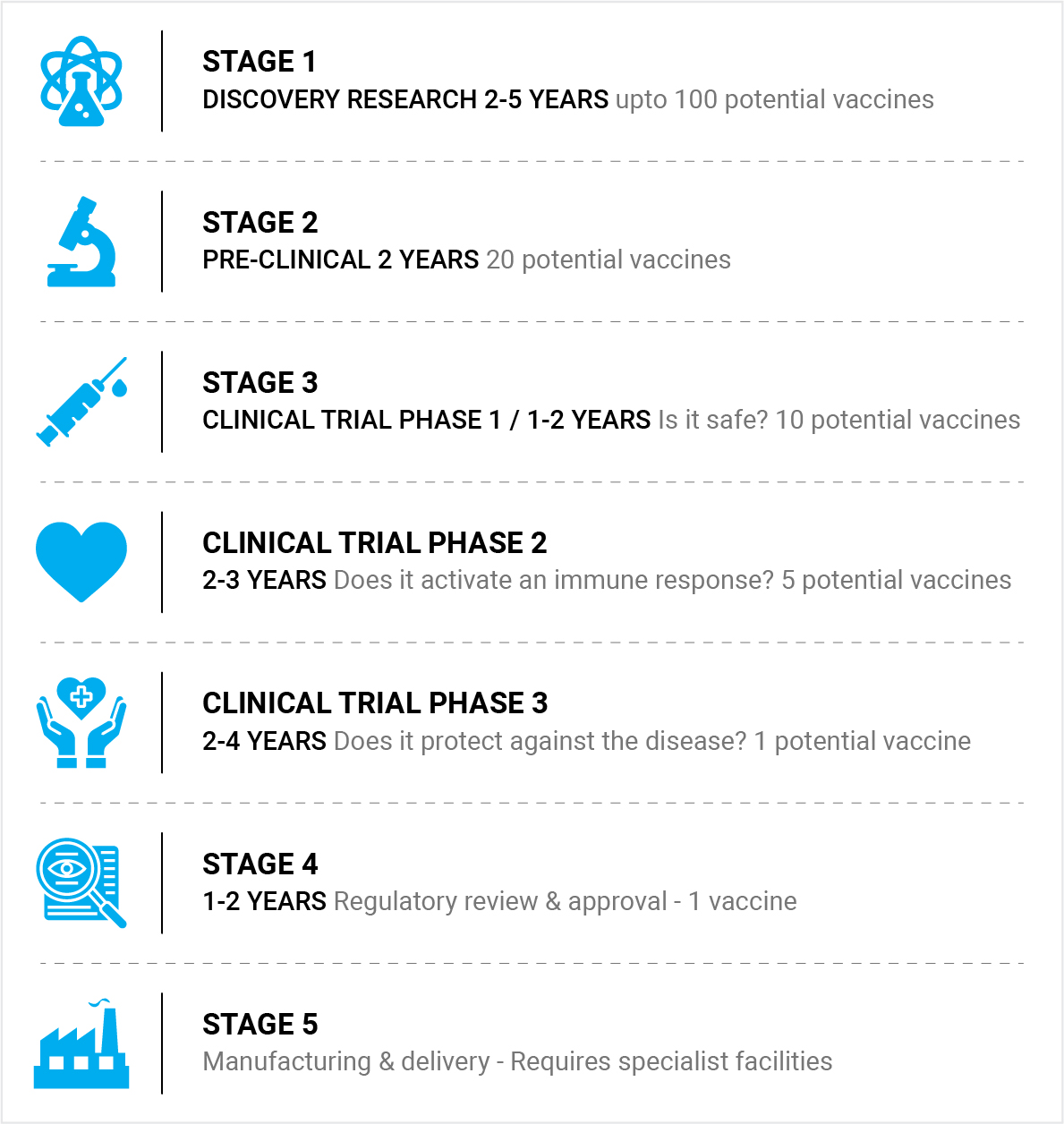

Governments around the world are expediting the usual approval processes in order to deliver a Covid-19 vaccine quickly. In fact, Russia has rolled out a vaccine already, but there is skepticism about its safety and efficacy, considering the ramped-up timeline. A vaccine takes a minimum of 10 years to develop (see infographic). The fastest a vaccine has ever been made is 5 years and the current vaccine candidates are merely months into the pandemic. Even if one was to ignore that, large scale manufacturing and a public launch is months away, may be mid 2021.

Source: World Economic Forum

2. Expecting a full and immediate restoration of economic activity is naive

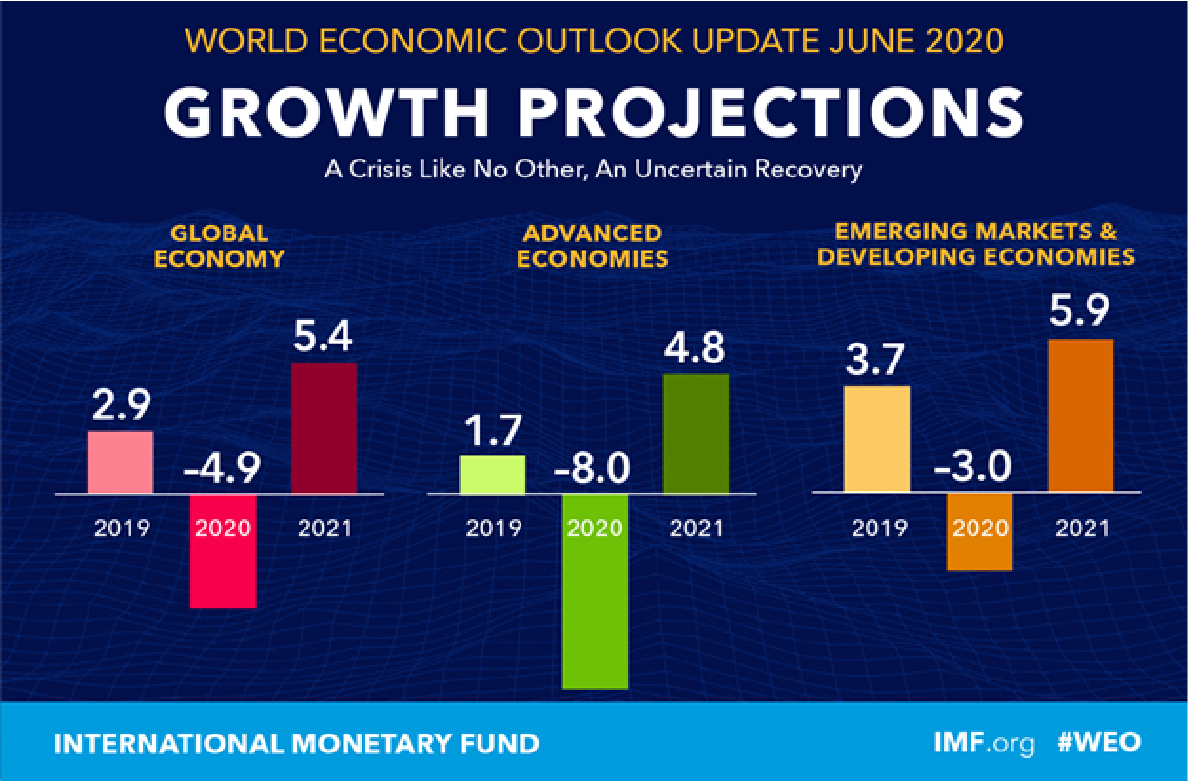

There is no doubt that a successful vaccine’s impact on the health effects of the pandemic will be positive, as and when a large-scale roll-out is achieved. But it can't undo the extraordinary economic damage caused over the last few months overnight. In fact, with a resurgence in cases in the United States and Europe, a complete reversal of the Great Lockdown has been further delayed, slowing the economic recovery. Thus, even though the announcement of a vaccine may lead to a temporary correction in gold prices, and drive up risk sentiment, ground economic realities will take time to fix. Till then, normalcy and certainty will evade us and investors will prefer the stability of gold.

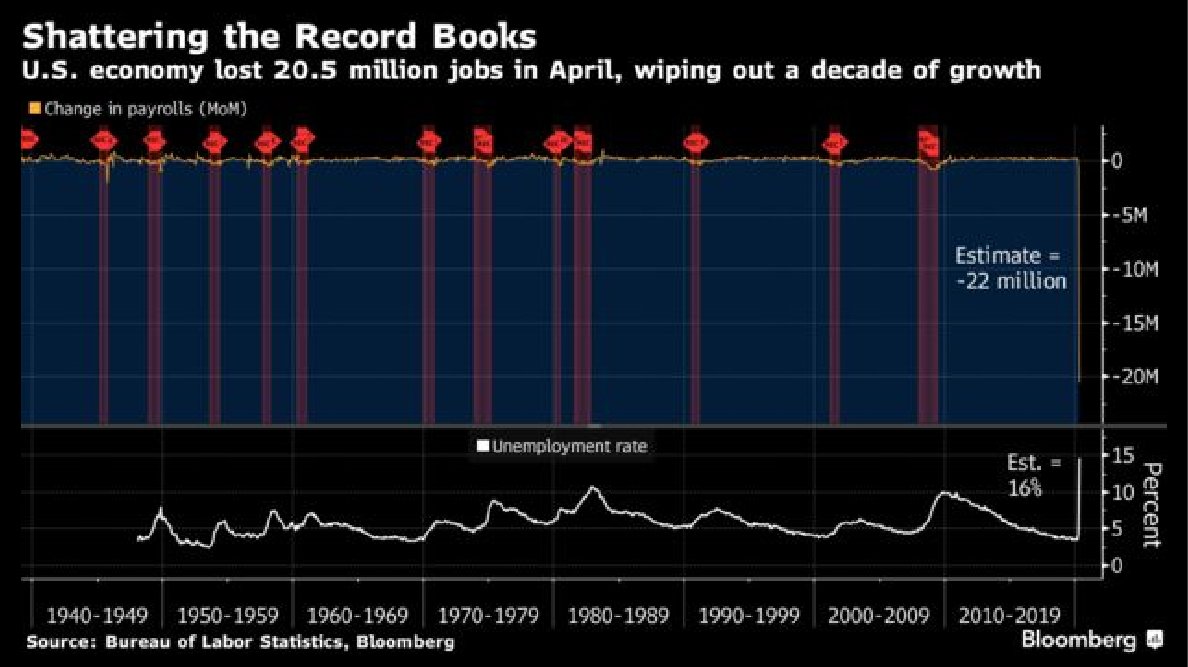

3. Weak economy needs Government support

The economic damage has been severe and therefore it will take longer for the economic recovery. The World Bank estimates that a full recovery will take 5 years. It took almost 7 years to recover the jobs from the last unemployment peak in the U.S, this crisis has seen almost triple the size of job losses. This helps reconcile what the World Bank says, it will take longer and will need some heavy lifting from the government. To support the beleaguered economies, governments will have to resort to more stimulus measures over next 2-3 years, more spending which will result in more deficits and rising debt. Gold should continue to benefit from this spendthrift policy making.

4. Low yields will continue to limit bonds’ utility

Investors can expect sustained accommodative policies to get the battered economy back on its feet over the next few years. Central banks continued to remain accommodative for six years following the Global financial crisis of 2008 and this is many times more severe than that. Thus, bond yields and short-term interest rates are bound to stay low in nominal terms and negative in real terms for the foreseeable future. The Federal Reserve has announced that it will be keeping rates near zero till 2023. Such low yields will limit bond markets’ ability to act as a hedge against equity price volatility and at the same time minimize the opportunity cost of holding zero-yielding gold. This will be bullish for the yellow metal.

5. Weaker dollar and inflation on the horizon

Unlike the Global financial crisis where new money creation went to banks and financial institutions, this time the massive monetary policy easing and never seen before government relief packages seems to be trickling fast to the real economy. The monetary inflation is resulting in a weaker dollar. A weaker dollar and high liquidity could result in higher commodity prices as well and therefore could be inflationary. The Federal Reserve has announced that it will adopt an average inflation target going forward that will allow inflation to run above 2%, to support the pandemic-struck economy. Gold, known for preserving purchasing power, will become a preferred asset in such times.

Conclusion

Last month’s reaction in gold prices is only temporary and the outlook for gold remains positive. Benefit from the long term prospects of gold which acts as a counterweight to fiat money which is increasingly losing credibility.

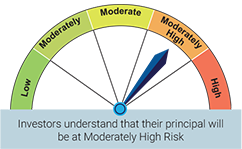

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly View for March 2024

Posted On Thursday, Apr 04, 2024

The Fed in its March 20th policy decision kept its key interest rate unchanged...

Read More -

Gold Monthly View for February 2024

Posted On Wednesday, Mar 06, 2024

Fed Chair Powell made it amply clearly that the US central bank is in no rush to cut rates with his “danger of moving too soon is that the job’s not quite done” and the “the prudent thing to do is to just give it some time” comments.

Read More -

Gold Monthly View for January 2024

Posted On Monday, Feb 05, 2024

Aggressive rate cut bets unwound in the first month of the new calendar year on the back of strong economic data in the United States.

Read More

Get In Touch

Take small steps in your financial planning to achieve big dreams! Start your investment journey today!