The Secret Sauce for A Comfortable Retirement

Posted On Saturday, Sep 26, 2020

Sooner or later in life we all will get there...

Today, we may be earning well and are able to meet our needs easily.

But someday this income flow is going to slowdown.

And even as that happens, our expenses will keep rising due to inflation.

This will make it hard for us to match our incomes and expenses in the long run.

Imagine living without the comforts that we are used to now.

Imagine having to cut back on some of them once you retire and you no longer can afford these comforts.

What should you do to retire comfortably?

Achieving a comfortable retirement is something everyone wants but very few achieve.

Planning for retirement is therefore a really important financial goal, no matter what your age is.

The sooner you act on it the better your chances of achieving a comfortable retirement.

Research your options and earmark the savings that will form the basis of your retirement corpus.

And don’t delay this.

How should you create a retirement corpus?

Of course, there may be many ways to achieve this goal.

But what you really need is a way in which you can grow your retirement corpus while protecting it.

From recessions, pandemics and whatever else may happen during our lifetimes.

This is where mutual funds enter the picture.

Mutual funds offer a lucrative yet safe way to create a retirement corpus and grow it in a consistent manner.

How to create a retirement corpus using mutual funds?

Let’s look at how retirement planning works.

Here is a retirement planning tool that you can use to estimate your retirement corpus requirements.

You should ideally begin to accumulate a corpus during your working years.

Which are the funds that can help you achieve a comfortable retirement?

Every investor has a different requirement, risk appetite, term of investment etc.

Mutual Funds are flexible enough to satisfy everybody.

Here are some types of funds that can enable you to achieve your retirement goals.

1. Equity Funds

This type of fund has the potential to get you high returns albeit at a higher risk. But Equities perform well in the long run and tend to make a good investment fund, especially if you begin investing at a young age.

Quantum Long Term Equity Value Fund (QLTEVF) for example, is a fund that is ideal for investors with a long term time horizon and looking for diversification in equities.

Systematic Investment Plans (SIP) are a great way to invest a fixed amount each month in equities.

2. Debt Funds

These are funds that invest in debt instruments such as government bonds and other fixed income assets. They are considered relatively less risky investments than equity.

Quantum Liquid Fund (QLF) for example is only investing in government securities and public sector companies. This way the fund tries to keep the credit and liquidity risks to the minimal levels.

3. Multi Asset Funds

A practical way to diversify your portfolio and rebalance regularly as per market movements is by investing in a multi asset fund.

This can be beneficial for a retirement corpus as they provide the convenience of diversification across different asset classes of Equity, Debt and Gold within a single product.

Quantum's Multi Asset Fund of Funds (QMAF) for example, invests across asset classes: Equity, Debt and Gold.

Why should you prefer mutual funds over other retirement products?

The simple answer to this is that there is far greater flexibility. However, investing in mutual funds requires discipline.

A common mistake we make is that we get attracted by the name of a financial product as opposed to its features.

A pension or a retirement plan may have retirement written all over it, but if you consider the fine print, you will agree with us that investing in mutual funds is the way to go.

You are far better off investing in equity mutual funds early on and gradually shifting investments to debt funds, as you move closer to your retirement.

Editor's note: To know more about investing in mutual funds for your retirement, write to us at [email protected] Or give us a missed call at +91-22-68293807 and we will call you back. We will be happy to assist you.

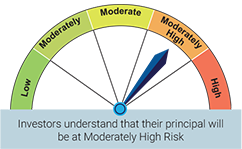

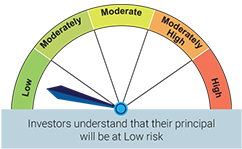

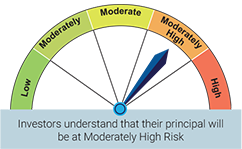

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Multi Asset Fund of Funds (An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  |

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Are You Stuck in the Past or Ready for a Secure Future?

Posted On Wednesday, Jun 29, 2022

The ever-growing number of mutual fund schemes on offer has made it challenging for investors to select the best and most suitable one.

Read More -

Received an Increment? Step-up Your SIPs

Posted On Wednesday, Jun 01, 2022

For instance, let’s assume that you have registered for a monthly SIP of Rs 5,000 for a 10-year period and later on try to step-up the SIP at an annual frequency, say by Rs 500. In the first year...

Read More -

Invest without Stress - With Quantum Mutual Fund!

Posted On Monday, May 09, 2022

Since inception, Quantum AMC has stayed true to its Vision and Mission.

Read More

Get In Touch

Take small steps in your financial planning to achieve big dreams! Start your investment journey today!