Are you Nervous about Markets? Here’s a Solution

Posted On Thursday, Dec 09, 2021

The feeling that you get while watching a tightrope walk is very similar to watching the market move up and down in the blink of an eye.

It moves from bad to worse and worse to overwhelming in no time.

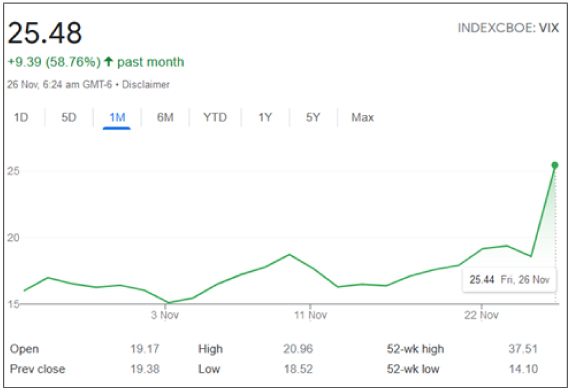

For past one month, the CBOE Volatility Index has also witnessed a constant rise in its levels.

What is the Volatility Index? ✓ Volatility is a statistical measure of the degree of variation in stocks trading price observed over a period. ✓ The CBOE Volatility Index (VIX) represents the real-time market's expectations for volatility over the coming 30 days. ✓ Technically, any level below or around 15 is considered low volatility and anything above 35 is considered high volatility. |

Source: CBOE Volatility Index, Data as of Nov 26, 2021

Market movements are very unpredictable and for a retail investor with average knowledge about market behaviour, it is very difficult and sometimes intimidating to try and make a prudent investment decision.

As there is uncertainty in the market, do you really have to lose your good night’s sleep? Is it really worth it.

What if we tell you, that there is a solution to sleep-tight and not worry about the bears or the bulls. A solution that helps you eliminate all your short-term worries and focus on your long-term financial goals.

After all, isn’t investing supposed to be simple?

What you need is a strategic asset allocation plan, one that has saved several investment portfolios from losses.

We have a strategy exclusively designed at Quantum which has the potential to help you reach your goals and not be nervous about market fluctuations.

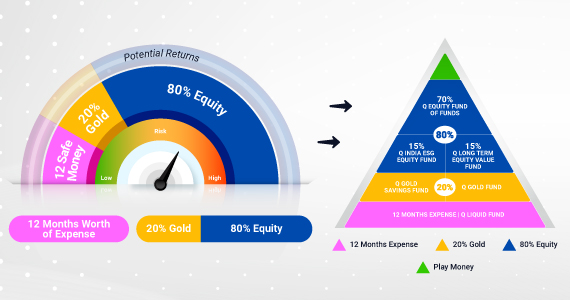

The Dynamic Trio – ‘12-20-80’

**Please note the above is suggested fund allocation only and not an investment advice / recommendation.

A tried and tested three-pronged asset allocation approach which has potential to give you long term risk adjusted returns. It’s simple, easy to understand and practical.

Step 1: Set Aside 12 Months of Emergency funds with Quantum Liquid Fund

The importance of an emergency corpus was recently felt the world over as countries experienced lock-downs. You can combat any situation when you are financially secure, whether that be a medical emergency, loss of a job or any other urgent need for funds.

To ensure this, the first step in your asset allocation is to park at least 12 months of your monthly expenses in an investment vehicle like a Liquid Fund or a Savings bank account. Liquid finds generally offer high liquidity and can be accessed at any time.

Use Quantum Liquid Fund to Invest Your Emergency Money

We believe that as wise investors, you should invest your emergency money in liquid fund that follows the SLR (Safety, Liquidity, Returns) principle and prioritizes safety and liquidity over returns.

Step 2: The 20% Golden Rule

Gold can never be old! Gold generally has negative correlation to equity and this helps you to benefit from its risk-reducing, return-enhancing characteristics generally in the times of crisis and financial repression.

The main reason to own gold is the sheer fact that it is an extremely good portfolio diversification tool. It thereby helps you to reduce overall portfolio risk. These corrective phases are just the opportune time that you can consider investing in Quantum Gold Savings Fund and Quantum Gold Fund ETF.

Liquidity & Purity - QGF and QGSF

Quantum Gold Fund endeavours to track domestic prices of gold by investments in physical gold. While Quantum Gold Savings Fund predominantly invests in the units of Quantum Gold Fund and allows you to invest in Gold via the SIP option. And you don’t need a Demat account to invest in it.

Step 3: Allocate 80% to Equity Funds

Equity mutual have the potential to offer you long term risk-adjusted returns and helps you cope better with inflation. However, comparing among over 350 equity mutual funds and zeroing in on one that suits your needs can be a cumbersome exercise. You can diversify your portfolio using the 70-15-15 Equity bucket that allocates your money in three sensible equity mutual fund schemes across various categories.

| Fund Name | Category | Suggested Allocation |

| Quantum Equity Fund of Funds | Fund of Funds | 70% |

| Quantum Long Term Equity Value Fund | Value Fund | 15% |

| Quantum India ESG Equity Fund | Thematic Fund (ESG) | 15% |

Please note the above is suggested fund allocation only and not an investment advice / recommendation.

Carefully selected, these three funds of Quantum Mutual Fund let you avoid the hassle of choosing the right fund from the pool of equity funds in the market. Let us look at each fund to understand its significant relevance in your portfolio.

The 70% - Quantum Equity Fund of Funds (QEFOF)

The 15% - Quantum Long Term Equity Value Fund

The 15% - Quantum India ESG Equity Fund

Simplifying Your Investment Portfolio with a Dynamic Asset Allocation Strategy

If you wish to have a diversified portfolio and do not have the time to track multiple funds in DIY asset allocation, you can consider investing in the Quantum Multi-Asset Fund of Funds.

Here the fund manager has the flexibility to follow a regular rebalancing approach within each asset class of equity, debt and gold, thereby giving you the potential to generate risk-adjusted returns through diversification of investments.

Your One Stop Solution to meet all your Asset Allocation Needs

With Quantum Mutual Fund, you have access to simple products that can be used as building blocks to create the perfect Asset Allocation Strategy that meets your needs.

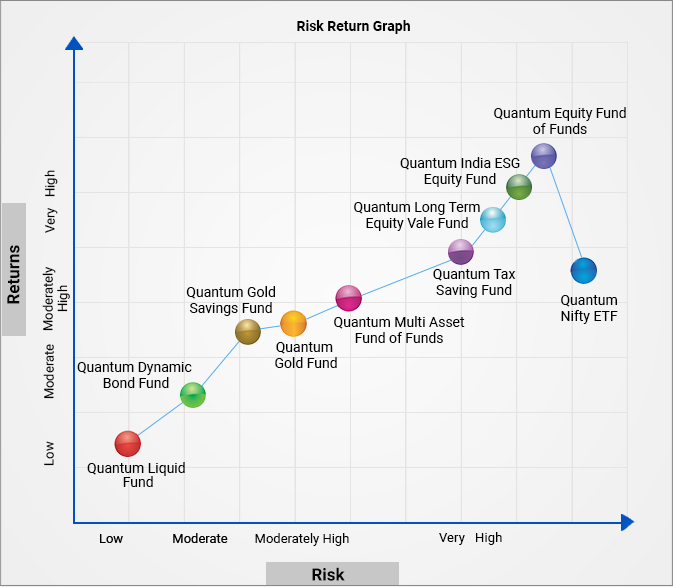

Illustrative Views of Risk Returns Graph of Quantum Mutual Fund Schemes

The above graph is for illustrative purpose to explain the concept of Risk and Returns in Quantum Mutual Fund schemes. Please review the actual returns and risk-o-meter of the respective schemes independently to make informed investment decision.

Switch off from the market noise, ride the market cycles by diversifying your investments with the Quantum 12-20-80 Asset Allocation Strategy.

Product Labeling

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Nifty ETF An Open Ended Scheme Replicating / Tracking Nifty 50 Index | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  Investors understand that their principal will be at Very High Risk |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments. |  Investors understand that their principal will be at Low Risk |

| Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on November 30, 2021.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix - Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

India's True Independence Shines Amid Global Economic Shifts

Posted On Friday, Aug 11, 2023

In today's rapidly evolving world, where economic dynamics are constantly undergoing seismic changes, India emerges as a resolute beacon of resilience and growth.

Read More -

Kickstart the New Year with a 12:20:80 Mutual Fund Portfolio Review

Posted On Tuesday, Dec 27, 2022

As the year draws to a close, it is a good time take a closer look at your investment portfolio.

Read More -

Your Anchor in a Storm - Grow your Wealth with a Value + Tax Advantage

Posted On Friday, Dec 23, 2022

The financial markets have been through a bumpy ride the past year – the Russia-Ukraine war has led to a global energy crisis and led to rising inflation and subsequent interest rate hikes.

Read More

Get In Touch

Take small steps in your financial planning to achieve big dreams! Start your investment journey today!