Start an SIP Today

-

** I agree to the terms and conditions mentioned below.

- SUBMIT

-

Call: 07021517993

Call: 07021517993

|

|

|

|

Best SIP investment plans are those kept for the long term

So, invest in Quantum Mutual Fund with a simple and easy SIP online in Quantum Mutual Fund today!

Find out how much to invest with our mutual fund SIP calculator.*

The time frame that I need this amount in is

1 YearsYou need to start a monthly SIP of Rs. 0* now!

Why Quantum

Quantum Mutual Fund puts the needs of investors like you first. It is for this very reason that we are India's most respected mutual fund. At Quantum Mutual Fund, we believe in sustainable growth, with integrity and have been helping our investors create wealth since 2006

Our investors believe in us and we believe in adding value to your investments by offering simple and easy-to-understand products.

Check out our funds and fund performance below and start your monthly SIP today!

Select Type Of Fund

Equity

₹ 1,00,000

Investment would have become ₹4,00,000.00

Suitable for: Diversification in equities over the long term

Past performance may or may not be sustained in the future

| Name of Scheme | This product is suitable for investors who are seeking* | Riskometer |

|---|---|---|

| Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) |

• Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |

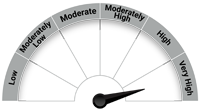

Investors understand that their principal will be at Very High Risk |

| Quantum Liquid Fund (An Open Ended Liquid Scheme) |

• Income over the short term • Investments in debt / money market instruments. |

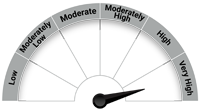

Investors understand that their principal will be at Low Risk |

| Quantum Gold Fund (An Open Ended Scheme Replicating / Tracking Gold) |

• Long term returns • Investments in physical gold. |

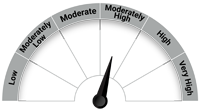

Investors understand that their principal will be at Moderately High Risk |

| Quantum Nifty ETF (An Open Ended Scheme Replicating / Tracking Nifty 50 Index) |

• Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index. |

Investors understand that their principal will be at Very High Risk |

| Quantum Tax Saving Fund (An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit) |

• Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |

Investors understand that their principal will be at Very High Risk |

| Quantum Equity Fund of Funds (An Open-ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds) |

• Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies. |

Investors understand that their principal will be at Very High Risk |

| Quantum Gold Savings Fund (An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund ) |

• Long term returns • Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |

Investors understand that their principal will be at Moderately High Risk |

| Quantum Multi Asset Fund (An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund) |

• Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold. |

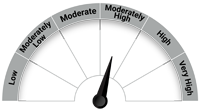

Investors understand that their principal will be at Moderately High Risk |

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) |

• Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities. |

Investors understand that their principal will be at Moderate Risk |

| Quantum India ESG Equity Fund (An Open Ended Equity investing in companies following Environment, Social and Governance(ESG) theme) |

• Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |

Investors understand that their principal will be at Very High Risk |